The RIFC 50 Index Recovers Strongly in 2021 Despite the Persistent Covid Pandemic.

Avis Budget Group, BBQ Holdings, and Joint Chiropractic Lead Index with Triple Digit Increases

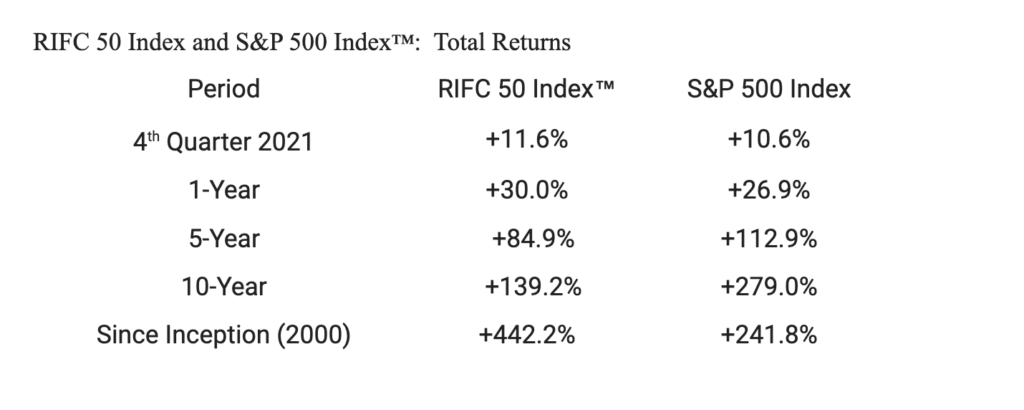

The RIFC 50 Index™ ended the year with a strong performance, adding 11.6 percent to its market value this last quarter of 2021. This performance confirms the solid recovery of the franchise sector despite the fast spread of the new omicron variant of the Covid virus. In 2021, the US franchise sector, as reflected by the RIFC 50 Index, grew faster than most US economic sectors (as reflected by the S&P 500 Index and the other major market indices).

Overall, the US and global economies staged strong recoveries in 2021, fueled by the widespread deployment of vaccines, stimulative fiscal policies, and expansionary monetary policies that have drastically expanded money supply and have kept the cost of capital very low with interest rates near zero. Reflecting these improved economic and health conditions as well as stronger corporate earnings growth, the S&P 500 returned a solid 26.9 percent, while the RIFC 50 Index had an even stronger return of 30.0 percent in 2021.

The year 2021 was still a challenging one for most businesses, including franchise businesses. The fast spread of the new omicron variant, widespread labor shortages, higher wages costs, supply chain disruptions, and accelerating inflation were tough challenges businesses had to face. Despite these challenges, many franchise businesses were successful in generating significant shareholder values. Among the components of the RIFC 50 Index, Avis Budget Group (+350%), Famous Dave’s of America (+267%), and Joint Chiropractic (+157%) generated the most increases in their shareholder values in 2021.

The RIFC 50 Index is up 30.0 percent over the last 12 months, up 84.9 percent over the last five years, up 139.2 percent over the last 10 years, and up 442.2 percent since its inception in 2000.